How Rising Healthcare Costs in 2026 Are Pushing Green Bay Families Toward Bankruptcy

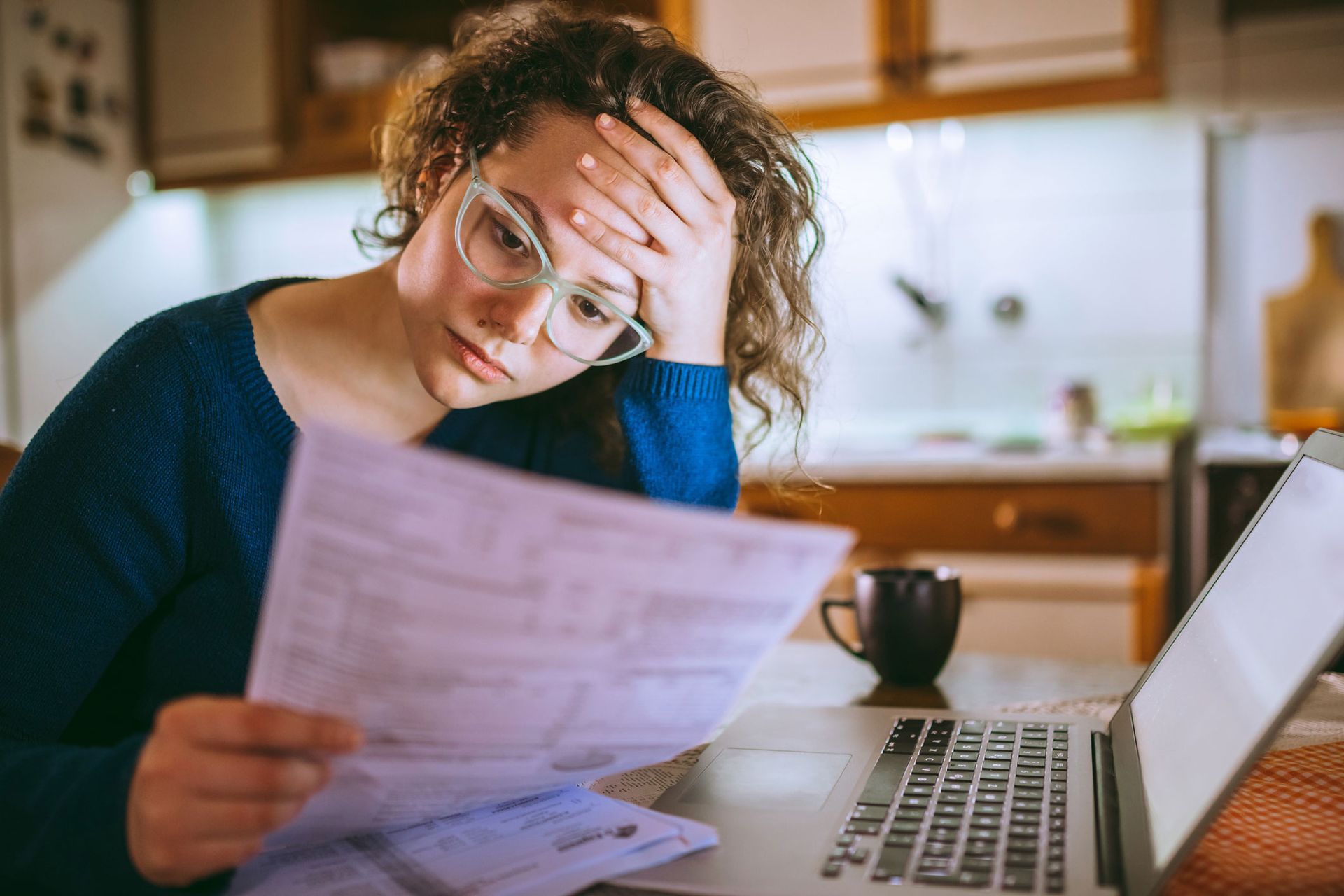

In recent months, rising healthcare costs have placed significant financial pressure on families throughout Green Bay. Higher insurance premiums, increasing deductibles, and growing out-of-pocket medical expenses have made it harder for households to stay financially stable—even for those with steady income and health insurance coverage.

Many families are discovering that a single medical emergency, surgery, or ongoing treatment can quickly result in thousands of dollars in medical bills. When these expenses are combined with everyday costs such as housing, utilities, and food, medical debt can become overwhelming.

Medical debt is one of the most common reasons individuals consider bankruptcy. Unlike other types of debt, medical bills are often unexpected and unavoidable. When bills go unpaid, they may be sent to collections, lead to lawsuits, or result in wage garnishment.

Bankruptcy Options for Medical Debt in Wisconsin

For Green Bay residents struggling with medical bills, bankruptcy may offer meaningful relief:

- Chapter 7 Bankruptcy may allow eligible individuals to discharge unsecured medical debt entirely, providing a fresh financial start.

- Chapter 13 Bankruptcy allows individuals with regular income to reorganize medical debt into an affordable repayment plan while protecting assets such as a home or vehicle.

Choosing the right option depends on income, assets, and overall financial goals.

If rising healthcare costs have left you facing overwhelming medical debt, the

Law Office of John Foscato can help. Attorney John Foscato works with individuals and families throughout Green Bay and Northeast Wisconsin to evaluate bankruptcy options and pursue lasting financial relief. Contact

www.BankruptcyAttorneyGreenBay.com today to schedule a confidential consultation and learn how bankruptcy may help you move forward.