HOW BANKRUPTCY MIGHT BE THE SOLUTION FOR SAVING YOUR HOUSE

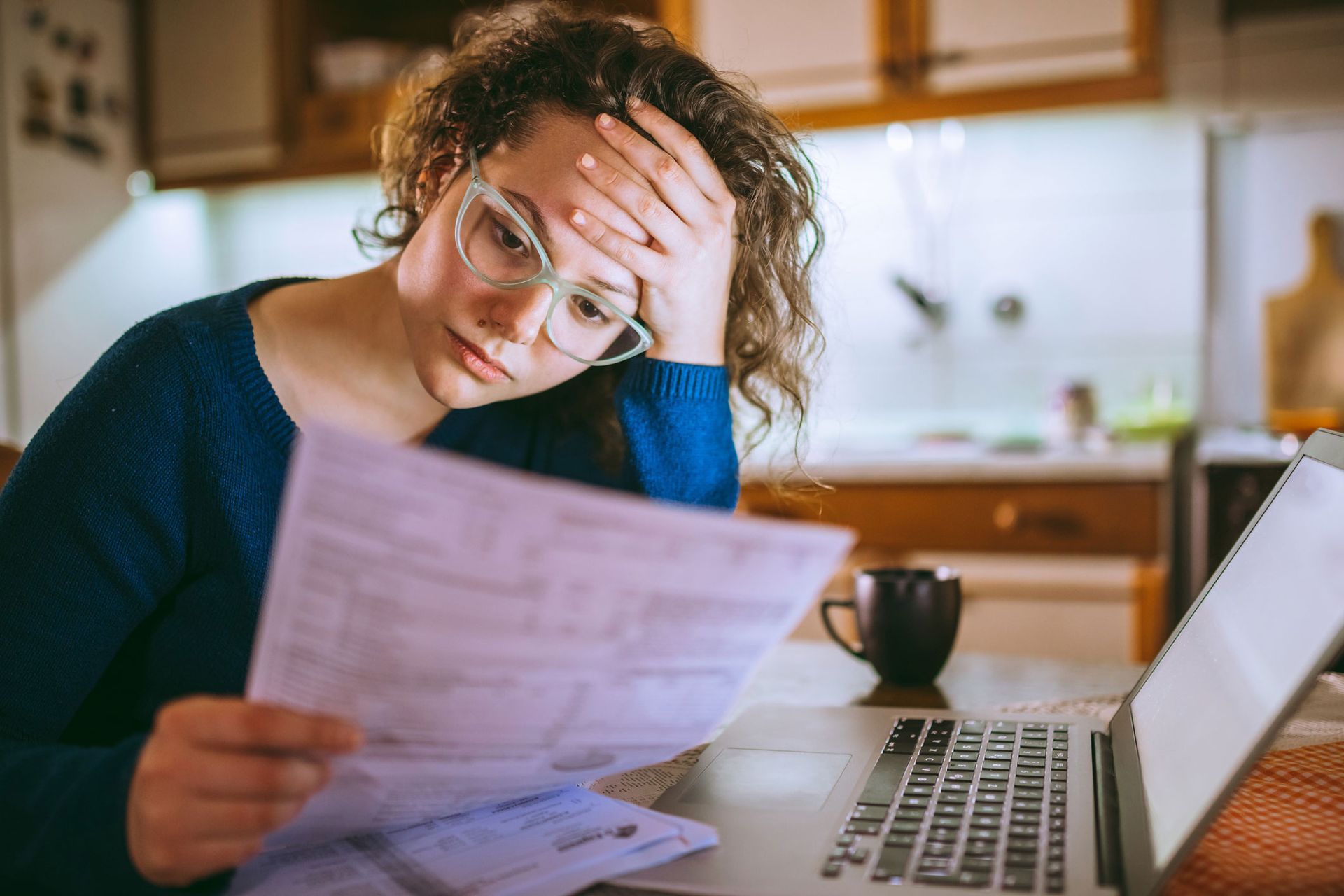

Receiving foreclosure papers in the mail might be the worst news you received in a long time, yet it probably didn't surprise you. When borrowers miss payments, lenders have the right to take their homes from them through the process of foreclosure. While reading foreclosure papers is scary, there might be a way you could stop the process and keep your home. The solution is filing for bankruptcy. How Bankruptcy Works Bankruptcy is a branch of law that allows people to gain relief from debts, and there are two main types of bankruptcies available to consumers. The first type is Chapter 7 , the preferred option in most cases, and the second type is Chapter 13. Both types require filing the necessary documents and fees; however, the outcome of each type is different. Chapter 7 discharges debts, meaning the filer never repays the debts included in the bankruptcy estate. Chapter 13, however, requires a plan of repayment, which lasts three to five years. The repayment plan requires repaying a certain percentage of debts, and the court determines this by the filer's income and debts. Times When Chapter 7 Is The Best Option Choosing Chapter 7 bankruptcy often appears as the best option, but this is not always the case. There are times when filing for Chapter 7 helps people stop foreclosures, but this depends on several important things:

- If you qualify – Before someone files for Chapter 7, a bankruptcy lawyer must perform a means test on the person's income. As long as the person's income meets the correct standards, the person could consider Chapter 7.

- If there is very little equity – The second thing a lawyer looks at is the equity in the home. If you owe very little on your home, Chapter 7 probably isn't a good idea, but it is a good idea for people with very little equity in the homes.

- If the lender agrees to it – The other important factor is that the lender must agree to let a person keep his or her home when filing for Chapter 7. Most lenders willingly agree to this when borrowers are not behind on their payments, but many lenders won't agree to it if borrowers are behind.

- Your lender won't agree to let you keep your house – Because you are behind on your payments, your lender has the right to deny your request to keep the house. With Chapter 13, your lender will not have a choice.

- You have too much equity in your house – If there is too much equity in your house, choosing Chapter 13 bankruptcy is the route you have to keep the house.

If you want to know more information about how bankruptcy works, contact The Law Offices of John A. Foscato, SC to schedule a free consultation visit with an experienced attorney.